Hot-rolled Coil Industry Update: Price Pressure and Technical Breakthroughs

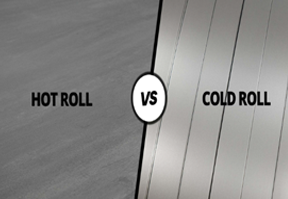

1. Market Prices Slide Amid Supply-Demand Imbalance

In H1 2025, hot-rolled coil prices trended downward. As of mid-June, Q235B hot-rolled coils in Tianjin and Shanghai were quoted at 3,150-3,310 RMB/ton, down from late May. This follows a 8.36% YoY increase in domestic output from Jan-Apr 2025, while exports plunged 20.88%, driving inventory buildup. Analysts expect prices to remain under pressure amid seasonal demand weakness.

2. Trade Frictions Escalate, Export Headwinds Grow

Vietnam imposed temporary anti-dumping duties on Chinese hot-rolled coils in Feb 2025, while Australia delayed its final "double anti" investigation ruling to Feb 2026. The EU's CBAM, effective 2026, will raise export costs for Chinese long-process steelmakers by 15-20%, pushing for low-carbon transitions. StrateGIc product adjustments (e.g., 1880mm wide coils) to avoid tariffs have drawn protests in Vietnam.

3. Technical Innovations Drive High-end Product Growth

Domestic mills made strides in high-strength hot-rolled coils:

- Ansteel mass-produced AH1500HS ultra-high-Strength Steel for automotive wheels, 30% lighter than traditional steel with 70% of aluminum wheel costs.

- Jilin Jianlong developed 2.5mm thin-gauge high-strength steel for new energy commercial vehicles, boosting profits by 200 RMB/ton.

- Digital systems now predict rolling parameters like oxide scale thickness, improving yield by 2.7% and cutting energy consumption by 15%.

4. Corporate Moves: Cost Reduction and Regional Optimization

Shougang Qian'an Plant cut rolling intervals by ~4.5 seconds and reduced energy consumption by 10.89% in 2024, increasing thin-gauge electrical steel output. Coastal bases (Zhanjiang, Fangchenggang) aim to raise capacity share from 30% (2024) to 35% by 2030 to optimize logistics.

5. Outlook: Challenges and Opportunities

The global hot-rolled coil market is projected to grow at 4.3% CAGR to $220 billion by 2030, led by new energy vehicles and wind power (25%+ demand growth). China faces overcapacity (78-82% utilization in 2025) but high-end products (high-strength, weather-resistant steel) may rise from 38% (2024) to 50% of output by 2030. Mills are urged to accelerate smart upgrades and explore Belt and Road markets to mitigate EU/US trade barriers.