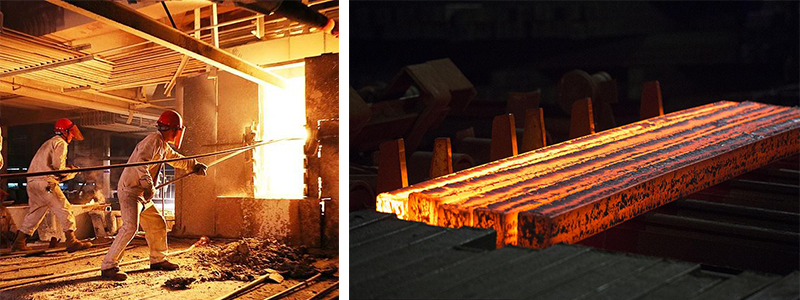

Steel Billet Prices Reverse Course, Showing Upward Momentum in Recent Days

In a notable shift from earlier trends, global Steel Billet prices have exhibited a rebound in recent days, driven by localized supply adjustments, cost pressures, and improved market sentiment. Here’s a detailed analysis of the key developments:

1. China: Regional Price Surge Amid Policy and Cost Factors

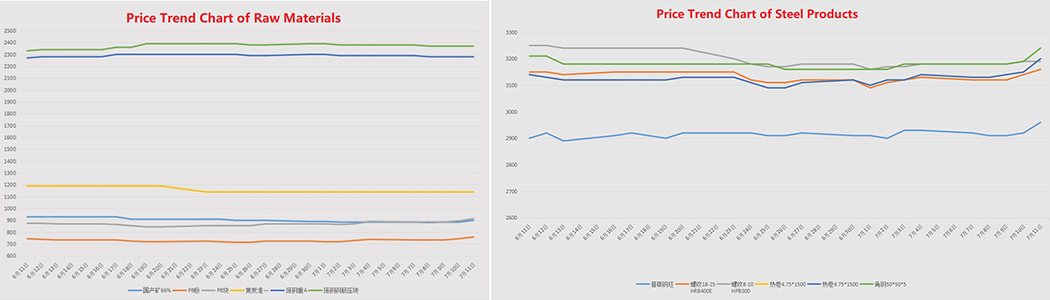

In China, the world’s largest steel producer, steel billet prices have seen modest but steady gains in select reGIons. According to the Xinhua Index, the average price of steel billets at Shandong Port rose by 20 yuan/ton (0.67%) to 2,990 yuan/ton on July 10 . This marks a reversal from the earlier downward trend, attributed to:

- Supply-side Restrictions: Some Steel Mills in Tangshan and surrounding areas have implemented production cuts due to environmental controls and maintenance schedules, reducing market availability .

- Cost Support: While iron ore prices remained relatively stable at 736 yuan/ton(as of July 7) , the recent rebound in coke prices—driven by supply tightness and resurgent demand—has bolstered production costs. Coke prices in Taiyuan held steady at 1,360–1,380 yuan/ton in early July, with traders expecting further increases .

- Policy Expectations: Anticipation of potential government stimulus measures, such as infrastructure investment or tax incentives, has lifted market confidence

2. International Markets: Mixed Signals and Regional Dynamics

CIS Region: Export Prices Inch Higher Despite Competition

Russian billet exporters have managed marginal price increases amid limited alternatives for buyers. Ex-Russia billet prices rose slightly to $408–410/ton CFR for September shipments, reflecting reduced availability of cheaper alternatives from Asia . However, strong competition from Turkish and Indian suppliers continues to cap significant gains.

Turkey: Domestic Weakness vs. Import Pressures

Local billet prices in Turkey have declined further, hitting $390–395/ton CFR for Iranian imports, as scrap costs dropped and demand remained sluggish . However, the country’s import market faces pressure from rising global prices, with buyers cautious about locking in contracts amid volatility.

Southeast Asia: Stable Offers, Soft Demand

Suppliers in Southeast Asia kept billet quotes unchanged at $405–415/ton CFR Manila, but slow construction activity and low finished steel prices dampened buying interest. Traders noted that “high” offers above $410/ton were met with resistance .

3. Key Drivers of the Rebound

- Cost Recovery: After months of decline, coke and iron ore prices stabilized in early July, providing a floor for billet prices. For example, Mongolian coking coal prices rose to $87/tonat China’s Ganqimaodu port on July 3, reflecting tighter supply .

- Seasonal Adjustments: While July is typically a low-demand period for construction, some mills preemptively reduced output to avoid inventory buildup, creating temporary supply gaps .

- Global Market Sentiment: Improved manufacturing PMI data in China (49.7% in June) and signs of economic resilience in Europe and the U.S. have reduced bearish sentiment .

4. Outlook: Caution Amid Uncertainties

While the recent rally offers respite, analysts warn that the upward trend may be short-lived due to:

- Weak Demand Fundamentals: Construction activity in China is expected to remain subdued until late August, with new housing starts down 23% YoYin H1 2025 .

- Export Challenges: Escalating trade barriers, such as Turkey’s $175/ton safeguard dutyon imported steel products , and potential U.S. tariffs on Chinese steel, could limit export-driven growth.

- Raw Material Volatility: Iron ore prices are projected to decline further in 2025, with Goldman Sachs forecasting a drop to $85/tonby year-end , which could erode cost support.

Market participants are advised to monitor government policies, weather-related disruptions, and global trade dynamics closely. While the current rebound offers opportunities, sustained recovery will depend on a broader economic upturn and structural adjustments in the Steel Industry.